Furio Oldani

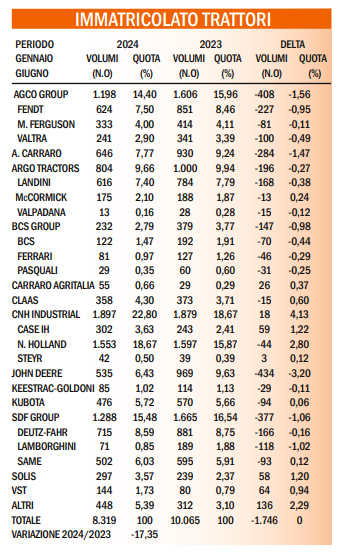

At the end of March, tractor registrations since the beginning of the year had shown a decline of over 25 percent, causing significant concern in the sector.

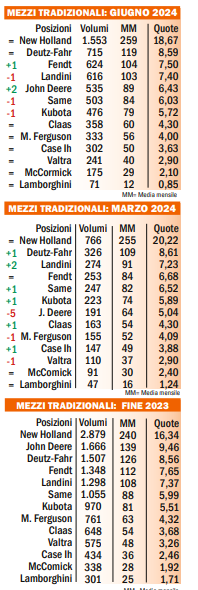

It was known that the market would decrease with the end of incentives, but no one expected it to do so so significantly and rapidly. However, by May, the decline had already eased, settling at a value slightly above 19 percent, which further improved to just under 17.5 percentage points in June, thirty days later. It is obviously difficult to determine if this recovery will continue throughout the year, bringing the market back to more traditional values, but the atmosphere among manufacturers is less heavy than it was at the end of March. At that time, not a single manufacturer had closed with growth compared to the same period the previous year, except for Asian manufacturers of low and medium-low power tractors, whose machines are primarily favored due to their low prices. By the end of June, however, in addition to the good performance of the oriental brands, Case IH and Carraro Agritalia also experienced growth.

The performance of those who closed even or limited their declines to a handful of units cannot be considered negative either. Among the first is Steyr, which grew by three machines, but it grew nonetheless; among the latter are Claas and McCormick, which experienced contained declines of between 13 and 15 machines, resulting in growth in terms of market share. These latter also saw numerous other increases, the most significant of which belonged to John Deere. Although it lost in volumes, it gained almost a percentage point and a half and two positions in the ranking of the best-selling traditional brands, to the detriment of Same and Kubota.

However, the SDF group made up for it with the Deutz brand, anchored in second place ahead of Fendt, which managed to surpass Landini by a handful of machines. New Holland remained on the top step of the podium. At the end of March, the leader was down by 106 tractors compared to the volumes of the first quarter of 2023, while by the end of June, the deficit had decreased to only 44 machines despite the attack launched by the aforementioned Asian brands, all experiencing significant growth and credited with decidedly important volumes. New Holland, Landini, Same, and Kubota are indeed the four traditional brands most engaged in the segments targeted by the Asians since these machines for now have power stopping below one hundred horsepower and therefore do not threaten foreign brands except marginally, making our specialist brands suffer instead. Antonio Carraro left almost 300 machines in the field, the three brands of the BCS group almost 150, and Keestrack-Goldoni about thirty, a volume that is not small, representing a loss of about 25 percent of the brand’s half-yearly registrations.

Author: Furio Oldani

Translation with ChatGPT